By: Himanshu Tiwari, International Center for AI and Cyber Security Research and Innovations (CCRI), Asia University, Taiwan, nomails1337@gmail.com

The inventory marketplace, a complex and dynamic economic environment, is based heavily on analyzing substantial datasets for selection-making and prediction purposes. However, centralized information processing poses sizable risks, inclusive of statistics breaches, privacy violations, and unmarried factors of failure. This paper introduces a singular method by imposing Federated Learning (FL) in inventory marketplace analyses, allowing for stable, privacy-compliant, and more dependable predictive modeling. We discover the realistic implications, advantages, and challenges of this integration, emphasizing the capacity for enhanced marketplace predictions without direct information entry to or compromising sensitive information.

1. Introduction:

The stock market is an intricate data-driven ecosystem where investment decisions depend on the continuous analysis of extensive market data[1]. Traditional methods involve:

- Centralized data collection and processing.

- Often raising concerns regarding data security.

- Privacy.

- Regulatory compliance.

Federated Learning, a form of machine learning where a model is trained across multiple devices or servers holding local data samples, promises a revolutionary shift. This study investigates the application of FL in stock market prediction, offering a decentralized, secure, and efficient approach to handling sensitive financial data[1].

2. Background and Related Work:

2.1. Data Sensitivity in Stock Markets:

The inventory marketplace’s dependency on sensitive records for trading strategies and selection-making approaches is properly documented. The centralized nature of conventional information analytics poses dangers of manipulation, breaches, and non-compliance with financial guidelines, necessitating better facts protection measures[1][2].

2.2. Federated Learning:

Federated Learning proposes a privacy-focused machine learning approach, allowing models to be trained on local data without being shared centrally. This method not only preserves data privacy but also allows for the inclusion of diverse datasets, potentially leading to more robust and comprehensive models[2].

3. Federated Financial Analytical Model:

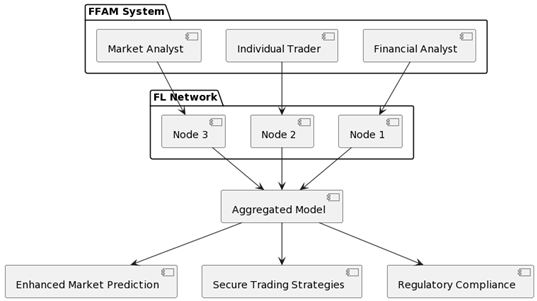

We suggest a Federated Financial Analytical Model (FFAM) that integrates FL into inventory marketplace prediction systems. This version allows financial analysts, buyers, and traders to make informed selections based totally on comprehensive market insights, even making sure records security and privacy[3].

3.1. System Architecture:

The FFAM operates within a network of various stakeholders, including financial institutions, individual traders, and market analysts. Each participant’s server or device acts as a node in the FL network, contributing to model training based on localized data. The aggregated model, improved through distributed learning, is then available for enhanced market prediction and analysis[3][4].

3.2. Implementation in Stock Market Analysis:

The FFAM can be instrumental in several areas:

– Secure Trading Strategies: Traders can develop and refine strategies based on insights gleaned from diverse, real-world data without exposing sensitive information.

– Regulatory Compliance: Ensures adherence to financial data protection regulations by processing data locally, reducing the risk of violations.

– Enhanced Prediction Models: By learning from a broader, more diverse dataset, prediction models can be more accurate and less prone to biases[4].

4. Privacy and Efficiency Considerations:

By decentralizing data processing, FFAM significantly mitigates privacy and security risks associated with traditional methods. Additionally, this approach can lead to more accurate and reliable market predictions by leveraging diverse, real-world datasets without central storage[4][3][1].

5. Challenges and Future Work:

Despite its potential, implementing FFAM poses challenges, including technical infrastructure requirements, standardization of data formats across nodes, and ensuring timely and secure communication within the network. Furthermore, achieving consensus among stakeholders and compliance with varying regional regulations requires careful navigation. Future research should focus on developing advanced federated algorithms tailored for financial data, effective anomaly detection systems for secure networking, and universal protocols for data ethics in federated environments.

6. Conclusion:

Integrating Federated Learning into stock market prediction represents a significant leap towards secure, private, and efficient financial data analysis. The proposed FFAM framework, while challenging to implement, sets the stage for a new era in financial analytics, where data security and privacy do not impede the quality of market predictions. As the financial sector continues to evolve, embracing such innovative solutions will be critical in promoting trust, regulatory compliance, and the overall robustness of financial markets.

References

- Ahmed, U., Srivastava, G. and Lin, J.C.W., 2022. Reliable customer analysis using federated learning and exploring deep-attention edge intelligence. Future Generation Computer Systems, 127, pp.70-79.

- Pourroostaei Ardakani, S., Du, N., Lin, C., Yang, J.C., Bi, Z. and Chen, L., 2023. A federated learning-enabled predictive analysis to forecast stock market trends. Journal of Ambient Intelligence and Humanized Computing, 14(4), pp.4529-4535.

- Sakhare, N.N. and Shaik, I.S., 2023. Spatial federated learning approach for the sentiment analysis of stock news stored on blockchain. Spatial Information Research, pp.1-15.

- Ahmed, U., Srivastava, G. and Lin, J.C.W., 2022. Reliable customer analysis using federated learning and exploring deep-attention edge intelligence. Future Generation Computer Systems, 127, pp.70-79.

- Bhatti, M. H., Khan, J., Khan, M. U. G., Iqbal, R., Aloqaily, M., Jararweh, Y., & Gupta, B. (2019). Soft computing-based EEG classification by optimal feature selection and neural networks. IEEE Transactions on Industrial Informatics, 15(10), 5747-5754.

- Sahoo, S. R., & Gupta, B. B. (2019). Hybrid approach for detection of malicious profiles in twitter. Computers & Electrical Engineering, 76, 65-81.

- Gupta, B. B., Yadav, K., Razzak, I., Psannis, K., Castiglione, A., & Chang, X. (2021). A novel approach for phishing URLs detection using lexical based machine learning in a real-time environment. Computer Communications, 175, 47-57.

- Cvitić, I., Perakovic, D., Gupta, B. B., & Choo, K. K. R. (2021). Boosting-based DDoS detection in internet of things systems. IEEE Internet of Things Journal, 9(3), 2109-2123.

Cite As:

Tiwari H. (2023) Federated Learning in Financial Markets: A Paradigm Shift for Secure and Efficient Stock Market Predictions, Insights2Techinfo, pp.1