By: Dadapeer Agraharam Shaik, Department of Computer Science and Technology, Student of Computer Science and technology, Madanapalle Institute of Technology and Science, Angallu,517325, Andhra Pradesh.

Abstract:

Thus, a growth has been observed in the use of digital transactions which raises the issue of how to prevent fraud. Machine learning or Artificial Intelligence (AI) has proved to be an effective solution in the case of this domain to deal with the fraudulent activities and safety of identity verification processes. Based on the understanding of AI and how it works in identity verification as well as its ability to prevent fraud, the following are the benefits, drawbacks, and the future trend of AI integrated identity verification solutions and services. Machine learning, biometric authentication and predictive analytics are the most notable ways through which AI is revolutionizing the digital security space who is in favour of business as well as in favour of the consumer.

Keywords: Artificial Intelligence, Identity, Authentication, Scam Prevention.

1.Introduction

With the current advances in technologies, secure identity verification and fraud prevention are dire assets in the contemporary world. Thus, owing to the constant enhancement of online transactions, identity theft as well as fraud issues have become a challenge to users and firms. The previous security means like login credentials and questions/answers to security questions are not effective against today’s fraud schemes. That is why Artificial Intelligence (AI) is able to provide more sophisticated approaches with regard to security and data protection. With the help of cornerstones like machine learning, biometrics and related technologies, as well as predictive analysis the field of identity verification and fraud prevention can rely on real-time detection, automated procedures and even the possibility to learn from experience. In entering the discussion of the benefits and risks of using AI in this regard, it is clear that while AI excels in aspects of productivity and effectiveness, it is not without drawbacks such as the moral and privacy issues that takes form concerning the practical application of the technology.

2. Advanced authentication and authorization

Through AI and ML, one can recognize patterns within a large amount of data to enhance the identification and filtering of users. Such technologies allow preventing unauthorized access by studying users’ behaviour and using it to define peculiar activity that should be blocked. Using AI and ML for adaptive authentication, a website or an application can constantly check the risk level of a user login attempt and demand a higher level of verification if the activity is risky or can ease the process of verification for trusted users to increase trust. [1]

- Risk-based access control

Although, the key complica- tion of IAM is to manage the interplay between protection and usability. This is how artificial intelligence and machine learning can resolve this issue by applying the risk-based access control. They are able to ‘guess’ whether it was an action performed by a user was premeditated for a malicious intent or is genuine, and assign certain risk scores accordingly — all with the help of data that has been previously processed. Thus, through the presented insights of the shifting patterns of user activity, organizations are able to maintain that no user has too much access or too little for their position. It reduces the possibilities of the intrusion of unauthorized people while at the same time facilitating the work of legal personnel[2].

- Automated provisioning and deprovisioning

When it comes to users’ account creation and deletion, AI and ML can be applied to reduce the load of IT administrators and guarantee adherence to company standards. Using the parameters of users, their roles and history of actions, it is possible to identify the request and assign the necessary permissions for new personnel or structural changes in the organization. Also, by using artificial intelligence and machine learning, when an employee departs a firm, various system and application accesses are automatically taken away.

- Fraud detection and prevention

Financial institutions and e-commerce platforms are businesses vulnerable to fraud and cyber attacks because they deal with electronic monetary transactions most of the time. In today’s Tech era, big data analytics and AI/ML can scrutinize large and complex datasets in real-time to identify fraud characteristics and unauthorized access than rule-based tools. Known techniques are effective in the continuous observation of users and network traffic, they can identify compromised activities such as account compromise attempts or fraudulent transactions [1].

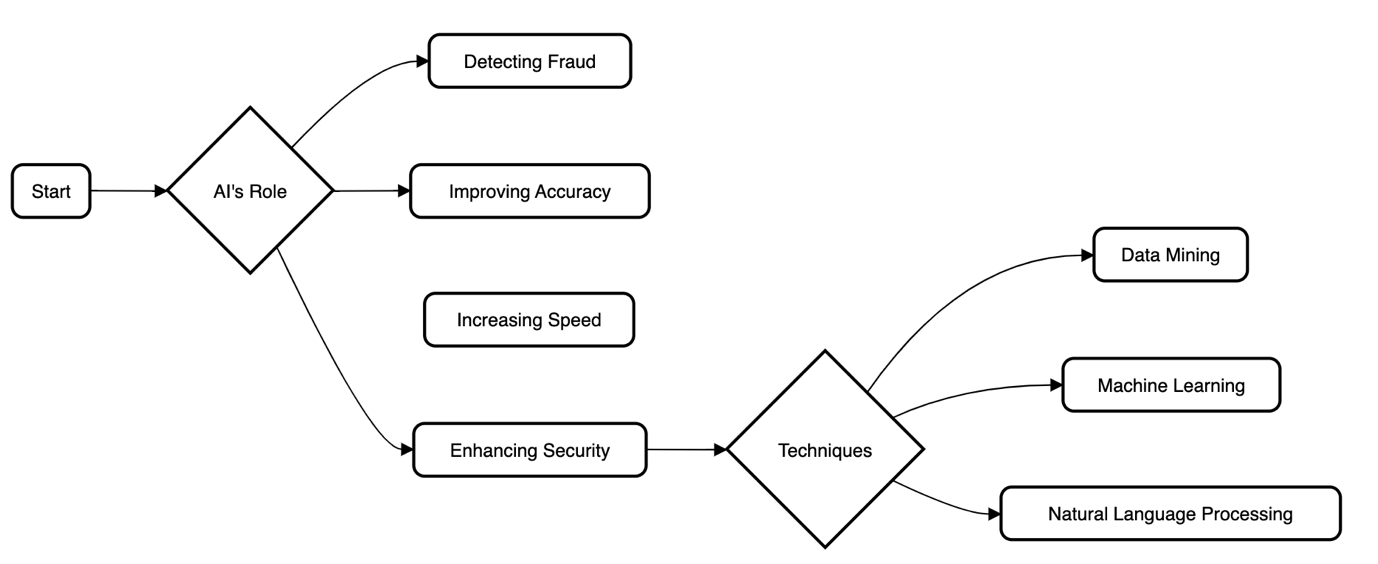

3.AI’s Role in Improving level of Fraud Detection

Also due to enhancements in Internet and technological aspects a new generation of monetary exchange platforms tagged the ‘fintech’ companies have emerged. While Novel complexity and user base have expanded dramatically, so have the nature and the incidence of financial crimes, which pose major threats to financial honesty and safety in the digital economy. However, the increasing complexity of fraud schemes has posed several difficulties for the sector On this front, Artificial Intelligence has come out as one of the most powerful tools in improving the capability of fraud detection in fintech.

Machine learning (ML) and deep learning (DL) have reformed the identification and prevention of fraud by applying AI technologies for the task. With the help of AI, modern fintech businesses can analyse large amounts of data, identify fraudulent schemes, and prevent fraudulent purchases at the level of individual transactions. It not only makes the financial transactions secure but also maintains the reliability and smoothness of the experience that the users have.

The proactive capacity of AI goes beyond simple transactional monitoring, including data analysis to investigate customers’ actions and words. It is a complete approach, which appreciates possible frauds, for instance, identity theft and phishing attempts before they cause financial losses. Additionally, the learning algorithms involved in the AI approach continue to learn and improve the model’s forecasting effectiveness with the aim of outcompeting intelligence fraud plans[3].

The proactive capacity of AI goes beyond simple transactional monitoring, including data analysis to investigate customers’ actions and words. It is a complete approach, which appreciates possible frauds, for instance, identity theft and phishing attempts before they cause financial losses. Additionally, the learning algorithms involved in the AI approach continue to learn and improve the model’s forecasting effectiveness with the aim of outcompeting intelligence fraud plans[3].

Nevertheless, its prospects are almost limitless as the use of artificial intelligence in fraud detection presents its challenges such as data security and privacy, ethics of decisions made by the AI, and issues concerning bias in the algorithms. Solving these problems is important for preserving user’s trust in AI and stressing the importance of raising proper AI policies[3].

This introduction emphasizes the importance of AI for the development of fraud solutions in the fintech sphere. It also emphasizes the use and the effectiveness of applying various innovative AI technologies in fighting financial frauds, at the same time focusing on the ethical aspect related to their implementation [4].

Conclusion:

The key advantage therefore comes with AI’s promise in handling patterned, complex but comprehensive data sets, delineating past and current fraud trends, and future possibilities. Subsequently, through the use of machine learning techniques, this paper explains how advanced authentication techniques involving biometrics application improve the identity assurance of enterprises. Not only does this aid in protection against other people’s interference but also addresses the issue with numerous and complicated typical identification procedures. Thereby, predictive analytics goes a step further in enabling organizations to respond to fraud more proactively, reducing financial damage and keeping their clientele’s trust.

In Conclusion, it is worthy of noting that the apply of AI in these domains might entail certain crucial issues. Data stewardship is important because prevention of data leakage is key when utilizing data in an AI system. Another measure that should not be overlooked is the issue of disparity because it is equally significant to eliminate discrimination that can distort the main principles of artificial intelligence and its applications in decision-making processes. Some key contingencies of AI operations regard ethical issues like openness in the functioning of AI systems and asserting responsibility for the results offered by the algorithms. The two must engage in constant dialogue as well as work hand in hand with the rightful stakeholders in forming the right frameworks that shall allow the utilization of AI in identity verification and prevention of fraud in a more ethical manner. Thus, the establishment of such collaborative environment opens the possibilities for the optimal use of AI in ensuring the safekeeping of digital assets and strengthening the defence’s in the shift toward the new generation of digital environments.

Reference:

- P. Khare and S. Arora, “The Impact of Machine Learning and AI on Enhancing Risk-based Identity Verification Processes,” Int. Res. J. Mod. Eng. Technol. Sci., vol. 06, pp. 8246–8255, May 2024, doi: 10.56726/IRJMETS57063.

- A. M. Widodo et al., “Port-to-Port Expedition Security Monitoring System Based on a Geographic Information System,” Int. J. Digit. Strategy Gov. Bus. Transform. IJDSGBT, vol. 13, no. 1, pp. 1–20, Jan. 2024, doi: 10.4018/IJDSGBT.335897.

- M. Rahaman, F. Tabassum, V. Arya, and R. Bansal, “Secure and sustainable food processing supply chain framework based on Hyperledger Fabric technology,” Cyber Secur. Appl., vol. 2, p. 100045, Jan. 2024, doi: 10.1016/j.csa.2024.100045.

- P. O. Shoetan and B. T. Familoni, “TRANSFORMING FINTECH FRAUD DETECTION WITH ADVANCED ARTIFICIAL INTELLIGENCE ALGORITHMS,” Finance Account. Res. J., vol. 6, no. 4, Art. no. 4, Apr. 2024, doi: 10.51594/farj.v6i4.1036.

- Al‐Qurishi, M., Rahman, S. M. M., Alamri, A., Mostafa, M. A., Al‐Rubaian, M., Hossain, M. S., & Gupta, B. B. (2018). SybilTrap: A graph‐based semi‐supervised Sybil defense scheme for online social networks. Concurrency and Computation: Practice and Experience, 30(5), e4276.

- Mishra, A., & Gupta, B. B. (2018). Intelligent phishing detection system using similarity matching algorithms. International Journal of Information and Communication Technology, 12(1-2), 51-73.

Cite As

Shaik D.A. (2024) AI in Identity Verification and Fraud Prevention, Insights2Techinfo, pp.1